Tag Archives: college

THE WAR ON COLLEGE EDUCATION. PART 2

I was at the Target store in Emeryville today. It”s a fairly large store with 12 checkout lines – but only 1 live cashier was on duty. Customers were encouraged to use the self-checkout registers instead. From a practical standpoint, customers didn’t have much choice. There was a long line of people waiting for the 1 live cashier. The same thing is happening at supermarkets everywhere. Supermarkets and lots of other stores are replacing cashiers with self-checkout registers. Did you read that Amazon just opened its first 100% self-service convenience store in Seattle? It’s like a 7-11, but with no cashiers, none at all. Amazon plans to open these stores all over the country.

According to a new study by the McKinsey Global Institute, robots and automation will eliminate 800 million jobs around the world by 2030. As shocking as this number may sound, it is in line with other studies on the same subject. The jobs most likely to be eliminated by automation are low-skilled, low paying, repetitive jobs. You don’t need a crystal ball to know this is coming. Just look at what’s happening to cashiers. And it isn’t just cashiers. All sorts of jobs are being eliminated by automation and robots. The jobs of the future will require more education than the jobs that are disappearing. What will happen to the U.S. if our educational system is producing mostly high school graduates who are only qualified to work at the kind of jobs that are disappearing?

THE WAR ON COLLEGE EDUCATION.

Last month, the House of Representatives passed a tax bill that made college tuition waivers taxable income. Senate leaders removed this provision from the final draft of the tax law just after strong national public uproar against this provision. Had this provision remained in the final law, tens of thousands of graduate students would have been forced to drop out of college because they would not be able to pay this new tax. The tax on tuition waivers would have taxed the discount graduate students receive for working in labs and teaching classes. The problem is that you can’t pay income tax if you have no income, and a discount is not income. The House bill would have eliminated the deduction for interest on student loans as well, but this too was eliminated in the final law due to public outcry.

All over the country, state legislatures are passing laws designed to make college education less affordable. Did you know that in a lot of states, if you don’t pay your student loans on time, you can lose your job? For example, if you are a physical therapist and you get behind in your student loans payments, your license to work can be revoked in 20 states. If you default on a student loan, you can be fired as a schoolteacher in 11 states. And in South Dakota, Iowa, and Oklahoma; if you don’t make your student loan payments on time, the state can take away your driver’s license. In other words, if you went to college and are not making your student loan payments on time, the state can take away your ability to work in your profession. Then how do you repay your student loans?

SOUTH DAKOTA. South Dakota has perhaps the most punitive student loan default laws. If you default on a student loan in South Dakota, they can take away your driver’s license. However, if you default on your mortgage on a multi-million dollar mansion overlooking Mount Rushmore – well – that’s OK. The state’s DMV can’t take away your driver’s license for just that. Taking away a person’s driver’s license, and in a largely rural state like South Dakota, for failing to repay a student loan on time seems just plain mean-spirited to me. Also, in South Dakota, if you get behind in repaying your student loans, you can also lose your license to work as a registered nurse, a physical therapist, or a speech pathologist; and if you are employed as a public schoolteacher in South Dakota, you can be immediately fired. Plus, at last count, about 1,500 people living in South Dakota were denied hunting and fishing licenses for failing to repay student loans on time. So, if you are behind in your student loan payments in South Dakota and you work in a licensed occupation, not only are you barred from working in your profession, but in addition, you can’t legally hunt or fish for your dinner. You can legally eat vegetables that you grow in your backyard. Sounds ridiculous, doesn’t it?

BERKELEY. Here in Berkeley, the main driver of college student debt is the cost of housing. A 2 bedroom apartment in a new building near campus costs $4,000 to $5,000 a month, but I’ve seen some that cost over $6,000 a month. Everyone in Berkeley city government is aware of this, but no one seems to be concerned about it. Quite the opposite. The mayor and Berkeley city council are constantly passing new laws and regulations designed to raise, not lower, the cost of building new apartments near campus. For example, a permit to build a new apartment house in Berkeley near campus now costs between $100,000 and $200,000 per apartment – and the council is planning to raise the price of permits next year. Now – who do you suppose ultimately pays for these astronomically expensive building permits? It’s just who you think it is! It’s the tenants who live in these buildings.

College students all over the U.S. are graduating with more and more student debt, and the cost of repaying that debt keeps rising. Every American should be very concerned about this. If a college education becomes just a privilege of the rich, as it was in Colonial times, we are in serious trouble as a nation. An industrialized society that does not value higher education is doomed to poverty and becoming a third rate and third world nation.

PARTY MYTHS

#1. THERE IS NO ‘RIGHT TO PARTY.’ A lot of tenants (not just college students) think that as an American citizen, you have a legal right to have parties in your apartment, but that is not true. There is nothing in the Constitution about a ‘right to party.’ It’s not in any state or local law either. Lots of leases contain provisions prohibiting tenants from having parties of any kind on the premises or that limit the number of people who can attend a party or that set limits on the dates and hours of parties. Lease clauses restricting and prohibiting parties are legal and enforceable in every state.

#2. YOUR NEIGHBORS HAVE A LEGAL RIGHT TO GO TO SLEEP AT A REASONABLE HOUR EVERY NIGHT. Disturbing the peace is illegal. You can be cited and fined for it, and in some cases even arrested. You are not being considerate or courteous to your neighbors by telling them in advance that you are going to have a party that will prevent them from sleeping. It is legally useless and could be dangerous for you.

Robbing Bank of America. Simply announcing in advance that you intend to do something that is illegal does not give you the right to do it. For example, it is not O.K. to rob a bank providing that you tell the bank in advance that you intend to rob them. Somebody actually did that here in Berkeley. There used to be a Bank of America on Ashby Avenue across the street from the Ashby BART station, 2 blocks from my house. It was where I did my banking. A man once robbed that bank with a gun. He didn’t wear a mask because he didn’t see any surveillance cameras in the bank, and so he assumed that there weren’t any, but he was wrong. This guy wasn’t very smart and was quickly caught. At his trial, the bank robber compounded his folly by acting as his own lawyer. He thought he had an airtight defense that was going to get him off. The bank robber told the jury that that he mailed a letter to the manager of the bank a week before the robbery stating that he intended to rob the bank. He included the date of his planned robbery in the letter. The manager of the bank testified that he received the letter but did nothing about it. He thought the letter was a practical joke or a fraternity initiation prank. The judge told the jury that simply informing the manager of the bank in advance that the defendant intended to rob the bank was not a defense. The bank robber went to prison. Surprisingly, this happens fairly often – that a criminal informs his victim in advance of the crime that he intends to commit in the belief that by doing so, it will give him some sort of legal cover if he is caught. That doesn’t work. As I often tell people – playing amateur lawyer is dangerous.

The idea that it is O.K. to have a loud party late at night providing that you told the neighbors in advance is an urban legend that gets college students into trouble all the time. Berkeley has one of the toughest noise pollution laws in the United States, and they enforce it. Berkeley policeman have decibel meters in their patrol cars. People having loud parties late at night in Berkeley are regularly issued large fines. Also, it can be dangerous to tell your neighbors in advance about your parties. Some people will interpret your notice as an invitation to come to your party, which can lead to awkward situations. Even worse, dishonest neighbors may come to your party to rob your place. Yes, that does happen.

Bank Fees You Can Avoid.

ATM Withdrawal Fees. These are less expensive, typically $2 or $3 per transaction, but they can add up. You can avoid these fees by using your own bank’s ATM machines or by using your supermarket’s cash-back feature when you pay with a debit card, which at most banks is also your ATM card.

Convenience Fees

The Best College Swimming Pool.

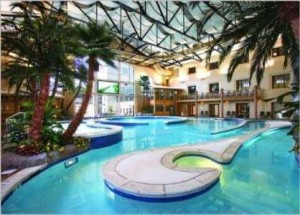

The swimming pool at the RSF (Recreational Sports Facility) on the U.C. Berkeley campus is certainly much better than the average college swimming pool, but it is far from top of the heap. The best college swimming pool in the United States is probably the one at the University of Missouri in Columbia. Below is a photo of the pool’s indoor lazy river, which is lined with palm trees and passes under a waterfall. Students can also join an on-campus, resort-quality beach club called ‘Truman’s Pond,’ named after President Harry Truman, who lived nearby.

The swimming pool at the RSF (Recreational Sports Facility) on the U.C. Berkeley campus is certainly much better than the average college swimming pool, but it is far from top of the heap. The best college swimming pool in the United States is probably the one at the University of Missouri in Columbia. Below is a photo of the pool’s indoor lazy river, which is lined with palm trees and passes under a waterfall. Students can also join an on-campus, resort-quality beach club called ‘Truman’s Pond,’ named after President Harry Truman, who lived nearby.

Do You Want To Work At Home? Get A College Degree First.

More and more people want to work at home, and it’s easy to see why. Rush hour traffic in the Bay Area is grinding to a crawl. In Los Angeles, it has been that way for decades. On a typical day, it can take an hour or more to drive 20 miles during rush hour on the I-5 in Los Angeles. Many other big American cities have rush hour traffic that is just as bad as L.A. I know people here in Berkeley who spend 3 hours every day driving to and from work. I am glad that I don’t have to do that. I have been working at home for 30 years. If you would like to work at home, get a college degree first. Data released by the Bureau of Labor Statistics last month shows that college-educated workers are more likely to work at home than any other group, aside from the self-employed. The data shows that while only 1 in 20 employees with less than a high school degree work at home, almost 40% of college graduates now work at home on a regular basis. Here are the numbers.

The percent of workers 25 years of age or older who worked at home on an average day in 2012.

High school graduate 12.7%

Some college, including associate degree 21.1%

Bachelor’s degree and higher 38.4%

Should College Students Be Allowed To Bring Loaded Guns To Class?

The University of California does not allow students to bring guns to class, but Cal students are allowed to dance, kiss, and watch R-rated movies. Furthermore, I am reliably informed that Cal students have been known to stay in motel rooms with members of the opposite sex. Anyway, that’s the rumor.