Late fees on credit cards are a major source of revenue for banks and credit card companies. Some banks make more money on late fees than interest. How can that be? If you make a late payment on a credit card, you will typically find a charge of $25 to $35 on your next monthly statement, but that isn’t where banks rake in the dough on late fees. If you make a late payment on a credit card – just one – the interest rate on your unpaid balance may automatically skyrocket. That’s particularly common on low interest rate credit cards. If you make a late payment on one of these credit cards, the interest rate on your balance may automatically go from 0% interest to 30% a year! Yes, that’s legal and, as I said, it is a very common practice. You agreed to that in the fine print of the terms and conditions of the credit card offer, the fine print that nobody reads. Plus, there are other negative consequences to having a late fee charged against you. The late fee will likely show up on your credit report because banks report late fees to the credit rating agencies. That can lower your credit score, which can lead to other negative consequences.

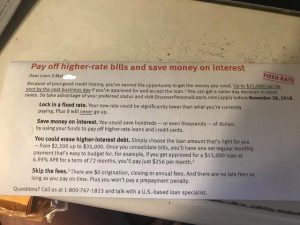

Late fees on credit cards are a major source of revenue for banks and credit card companies. Some banks make more money on late fees than interest. How can that be? If you make a late payment on a credit card, you will typically find a charge of $25 to $35 on your next monthly statement, but that isn’t where banks rake in the dough on late fees. If you make a late payment on a credit card – just one – the interest rate on your unpaid balance may automatically skyrocket. That’s particularly common on low interest rate credit cards. If you make a late payment on one of these credit cards, the interest rate on your balance may automatically go from 0% interest to 30% a year! Yes, that’s legal and, as I said, it is a very common practice. You agreed to that in the fine print of the terms and conditions of the credit card offer, the fine print that nobody reads. Plus, there are other negative consequences to having a late fee charged against you. The late fee will likely show up on your credit report because banks report late fees to the credit rating agencies. That can lower your credit score, which can lead to other negative consequences.Leon’s Loan Offer. One of my cousins recently got a loan offer in the mail. (See photo below.) The loan offer says: ‘Skip the Fees‘ in bold type. Then in smaller type it explains what ‘skip the fees’ means. It says: “There are no late fees as long as you pay on time.” Gee, what a great line! Maybe I should use that line the next time I get a move-out notice from one of my tenants. I could say in my rental ad: “No late fees as long as you pay your rent on time, and no returned check fees as long as none of your checks are returned.” I could also advertise: “No cat deposit required if you have no cat.” That reminds me of an ad I once saw from a jewelry store chain. They advertised: “100% Satisfaction Guaranteed! If after you have purchased a diamond ring from us, you are dissatisfied with your purchase for any reason, you can keep it.”